Online retailers are transforming warehouse construction

As e-commerce has soared in popularity, U.S. warehouses have evolved to meet the needs of online retailers, transforming from basic storerooms into automated, material-handling nerve centers.

Driven by consumers’ desire for fast and reliable delivery of everything from furniture and clothes to milk and toothpaste, these modern facilities are crucial parts of the supply chain for both e-commerce and brick-and-mortar brands like Amazon, Whole Foods, Kroger’s and Wal-Mart.

“It used to be that if a consumer ordered something and it showed up in five to seven days it was good service but now they are demanding that same item the next day or even the same day in certain locations,” said Chris Zubel, senior managing director of real estate company and research firm CBRE.

This expectation has led to a huge shortage of facilities that can quickly and efficiently process and ship massive amounts of merchandise, said Zubel. In fact, demand for distribution space is so great that builders and developers can’t keep up. CBRE reports that available warehouse space has come up short by about 170 million square feet every year since 2015.

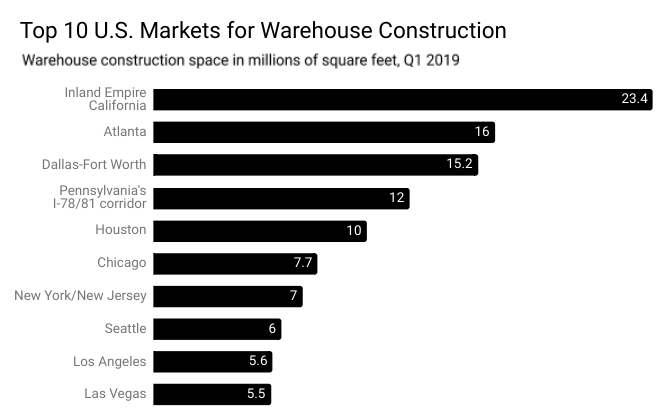

To meet the demand, several large markets across the U.S. have seen an uptick in distribution center construction this year, including Atlanta, Dallas and Chicago (see chart below).

The race to get products to the end-user as fast as possible has transformed the way warehouses are designed and built, said Brock Grayson, vice president at Layton Construction, which has constructed 10 million square feet of e-commerce distribution centers in the past five years for clients including Amazon, Macy’s, Home Goods and UPS.

“When I started in this sector in the late ’90s these buildings were further up the supply chain for our clients,” he said. “They were a place for taking product from the shipping yard or rail yard and getting it to brick and mortar stores which then sold it to the consumers.”

Two decades ago, those facilities were simple structures that relied on forklifts to retrieve goods that were stored on pallets until they were shipped to a store, he said. Since then, storerooms have morphed into high-tech distribution hubs that are the last stop in the e-commerce supply chain.

“Gone are the days of stacking the product on the [distribution center] floor and moving it via forklifts,” said Daren Sealover, project executive with Graycor Construction Co., which has built more than 20 million square feet of industrial space including distribution centers, cold storage warehouses and manufacturing facilities in the past five years.

Today’s centers require a higher level of expertise from builders, engineers and architects, according to Kathy Craft, principal and national industrial practice area leader for architecture firm Nelson.

“Warehouses once designated for singular functionality have become a mosaic of activities and engagement,” she said.

The tech revolution

One of the main drivers of this transformation has been the addition of high-tech sorting equipment. Twenty-first century retailers rely on automated systems like pickers and robots to move merchandise faster and sometimes with less labor. These automated systems require special design and construction considerations, experts say, and require builders to stay up to date on changing specifications.

Because of the fast pace of technological change, retail clients look for builders with a willingness to learn and adapt as a project develops, according to Mike Grella, Amazon’s director of economic development from 2012 to 2019 and founder of CSR-based economic development advisory firm Grella Partnership Strategies.

“The winning developers were often the ones that spent a lot of time in Seattle getting to know the executive team, the real estate team and the finance team, instead of just staying in their office waiting to respond to a RFP,” he said. “Those who were curious, wanted to learn the right way to build what we needed and engaged in long-term thinking about the relationship often got the job.”

Automated storage and retrieval systems (ASRS) are featured prominently in many distribution and fulfillment center projects. The robotics-driven technology can safely retrieve merchandise placed at heights of more than 120 feet, according to Jeff Bischoff, executive vice president of business development at Lexington, Kentucky-based AEC firm Gray.

Walmart’s 628,713-square-foot, cold storage, warehouse and distribution center under construction by Graycor in Shafter, California, will incorporate a 73-foot-tall ASRS that stores and retrieves items and loads pallets automatically. The new facility, set to open in 2020, will be able to process 40% more items than a traditional perishable distribution center.

At many Amazon plants, small robots designed by Amazon Robotics pick up 12-foot-high racks and bring them to packaging areas where workers pull items one at a time to fill orders. Elevated mezzanine structures are used to support the complex racking, conveying and robotic systems.

“The added height of the rack-supported structures and automation of newer facilities has created different issues for owners to contend with, and we have had to adapt to their needs in order to offer innovative solutions to these issues,” said Sealover.

At its distribution centers, retailer REI incorporates a 30,000-square-foot sorter, dubbed “the Beast,” said Grayson, who described it as a “gigantic vending machine.”

Other retailers use conveyor belts and chutes that route items through the facility to holding areas where they are packaged and shipped.

Scheduling is crucial because technology providers, electricians and other subs involved in the automated systems have to be kept in the loop.

“Our greatest successes have come from our early engagement via design-build using electronic communication tools and documenting face-to-face meetings to keep the entire team informed,” said Sealover.

While those interviewed said that building modern warehouses requires a builder with experience and patience, Grella said the most attractive quality for an e-retail client is flexibility, based on his years on Amazon’s team.

“It wasn’t always the developer with the lowest cost bid that won a deal,” he said. “You needed to demonstrate the ability to be nimble, creative, patient and adapt in real time.”

The second article in the series will look at eight other considerations builders face in the evolution of the distribution center.

This article was originally written by Jenn Goodman and appeared here.

Comment (0)