$68-billion California bullet train project likely to overshoot budget and deadline targets

The monumental task of building California’s bullet train will require punching 36 miles of tunnels through the geologically complex mountains north of Los Angeles.

Crews will have to cross the tectonic boundary that separates the North American and Pacific plates, boring through a jumble of fractured rock formations and a maze of earthquake faults, some of which are not mapped.

It will be the most ambitious tunneling project in the nation’s history.

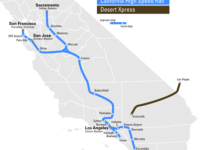

State officials say the tunnels will be finished by 2022 — along with 300 miles of track, dozens of bridges or viaducts, high-voltage electrical systems, a maintenance plant and as many as six stations. Doing so will meet a commitment to begin carrying passengers between Burbank and Merced in the first phase of the $68-billion high-speed rail link between Los Angeles and San Francisco.

However, a Times analysis of project documents, as well as interviews with scientists, engineers and construction experts, indicates that the deadline and budget targets will almost certainly be missed — and that the state has underestimated the challenges ahead, particularly completing the tunneling on time.

“It doesn’t strike me as realistic,” said James Monsees, one of the world’s top tunneling experts and an author of the federal manual on highway tunneling. “Faults are notorious for causing trouble.”

The California High-Speed Rail Authority hasn’t yet chosen an exact route through the mountains. It also is behind schedule on land acquisition, financing and permit approvals, among other crucial tasks, and is facing multiple lawsuits. The first construction began in Fresno in July, 21/2 years behind the target the rail authority had set in early 2012.

A confidential 2013 report by the state’s main project management contractor, New York-based Parsons Brinckerhoff, estimated that the cost of building the first phase from Burbank to Merced had risen 31% to $40 billion. And it projected that the cost of the entire project would rise at least 5%.

Parsons Brinckerhoff briefed state officials on the estimate in October 2013, according to the document obtained by The Times. But the state used a lower cost estimate when it issued its 2014 business plan four months later.

Jeff Morales, the rail authority chief executive, said he was not aware of the Parsons Brinckerhoff projection. A spokeswoman for the authority declined to discuss the differences in the estimates.

Public opinion polls taken over the years have shown that support for the project has ebbed as costs have risen — and at $68 billion, the budget is already more than double the $33-billion estimate made by the rail authority before California voters approved bonds for the project seven years ago.

Morales said he believes the costs can be reduced below the projected $68 billion, which includes a 10% contingency. The authority is applying the best construction and engineering methods in the world, and initial contract bids have come in below estimates, he said.

Morales also said the project can make up for any delays.

But Bent Flyvbjerg, a University of Oxford business professor and a leading expert on megaproject risk, said the lagging schedule, litigation, growing costs and permit delays arising so early in construction are warning signs that even more delays and higher costs are coming.

“You have an 80% to 90% probability of a cost overrun on a project like this,” Flyvbjerg said. “Once cost increases start, they are likely to continue.”

Flyvbjerg’s research found that high-speed rail projects around the world experience an average of 45% cost growth, though 100% increases occur in some cases.

Although the state hopes to correct some of its early setbacks, the odds are stacked high against it, said Robert Bea, a member of the National Academy of Engineering and a pioneer in civil engineering risk analysis.

“You can never make up an early cost increase,” Bea said. “It just gets worse. I have never seen it go the other way in 60 years.”

Of the challenges facing the bullet train, none is bigger than tunneling.

Although some large tunnels have been constructed elsewhere without difficulty, including the 3,399-foot Caldecott Tunnel in the Bay Area, others have encountered costly problems.

The 11-mile East Side Access tunnel in New York City, for example, is 14 years behind schedule, and the tab has grown from $4.3 billion to $10.8 billion. Boston’s 3.5-mile Big Dig was finished in 2007 — nine years behind schedule and at nearly triple the estimated cost.

Digging stopped on the 2-mile Alaskan Way tunnel under Seattle when a boring machine broke down in December 2013 and had to be retrieved for repairs, causing a multiyear delay with an unknown cost overrun.

The bullet train will require about 20 miles of tunnels under the San Gabriel Mountains between Burbank and Palmdale, involving either a single tunnel of 13.8 miles or a series of shorter tunnels.

As many as 16 additional miles of tunnels would stretch under the Tehachapi Mountains from Palmdale to Bakersfield.

The state will probably opt for twin bores — one for each of two parallel tracks. That means as many as 72 miles of tunneling before 2022.

Can it meet that schedule?

“No way,” said Leon Silver, a Caltech geologist and a leading expert on the San Gabriel Mountains. “The range is far more complex than anything those people know.”

Herbert Einstein, an MIT civil engineer and another of the nation’s top tunneling experts, said, “I don’t think it is possible.”

“Having looked at a number of these long tunnels, [the California] plan is aggressive,” said Einstein, who has consulted on a 35-mile-long tunnel under the Swiss Alps. “From a civil engineering perspective it is very, very ambitious — to put it mildly.”

Thomas O’Rourke, a Cornell University tunnel expert, also has doubts.

“My first gut reaction is that it is doable, but given the complex geology it is optimistically biased,” O’Rourke said. “There are a lot of unknowns. It is going to depend on the complexity of the geology and the ground conditions.”

Monsees, who retired in 2013 from Parsons Brinckerhoff as its senior vice president for tunneling, added, “They are behind and need to get off their rear end and move.”

The rail authority declined to make any of its tunneling engineers available for interviews.

The pace of tunneling will turn on a handful of factors, including how soon work begins, how fast digging progresses, and the amount of time needed to install track, ventilation, train signals, high-voltage lines and fire-suppression systems.

Morales said the state does not have a detailed schedule showing how those milestones will be met. He said the task will be left to future contractors.

Rail officials have said they plan to choose a route and secure environmental approvals for the Burbank-to-Merced line by 2017, at which point the tunneling itself could be put out to bid.

Bidders then would need time to prepare cost estimates. The only two construction contracts for the project so far were issued more than a year after environmental approvals were in hand.

After a contract is signed, the contractor can start the process of ordering the enormous, custom-built machines to dig through the mountains. Tunnel boring machines, or TBMs, typically take eight months to a year to build and deliver, said a spokeswoman for Robbins Co., the leading U.S. maker of the machines.

At that rate, tunneling could begin in 2019 at the earliest.

TBMs are 300 to 600 feet long and grind circular holes using rotating cutter faces. Staffed by crews of as many as 20, the machines typically operate 20 hours a day, five days a week — with the downtime needed mostly for maintenance and crew changes.

Once tunneling begins, progress will depend largely on the kind of soil or rock encountered.

Silver, the Caltech geologist, said the San Gabriels’ oldest rocks formed 1.7 billion years ago, 200 miles to the south. They became highly fractured as they were shoved north by movements of the Earth’s crust.

Tunnelers will find that rock types change frequently, creating conditions that are among the most challenging for tunneling.

“If it were one single mass of granite, it would be easy to drill through and provide structural support,” said Silver, who trained the Apollo astronauts in lunar geology and pioneered the dating of the San Gabriel Mountains. “But everything in the arc has been bent, shoved, stretched, compressed and metamorphosed.”

The mountain range lies in a giant crescent between two major faults, the San Gabriel and the San Andreas, which separates the Mojave Desert on the North American tectonic plate from the Los Angeles Basin on the Pacific plate.

Between the two major faults are many secondary faults. Some are vertical strike-slip faults that move laterally, and some are thrust faults that move vertically. Some are horizontal, traveling through the ground at various depths.

“Every one is going to slow things down tremendously,” said Monsees, the former Parsons Brinckerhoff tunnel expert.

A 2012 report by Parsons Brinckerhoff, obtained by The Times, warned the rail authority that the “seismotectonic complexity … may be unprecedented” and that the rail route would be crossing faults classified as “hazardous.”

The faults, changes in rock types and shattered rock cause many headaches, sometimes requiring changes in cutter heads. Doing so means stopping the machines while technicians crawl to the front to manually swap out as many as 40 to 60 cutter heads. A full swap of cutter heads can take an eight-hour shift, the engineers said.

Shattered rock causes additional problems in supporting the overhead formations, requiring workers to bore 10-foot-long holes into the ceiling and insert rock bolts that knit together blocks that weigh tons.

Morales, the rail agency chief executive, said he did not know what rates of advance will be possible. He said that will be determined by the contractors the state hires.

In good rock, such as limestone or chalk, TBMs can advance 100 to 200 feet a day. But in fractured mixed rock through fault zones, the advance rates can slow to 10 to 20 feet a day, Einstein of MIT said.

Einstein’s estimate is endorsed by other engineers, including one who has worked closely on the bullet train project and told The Times that 10 feet a day is the likely rate of advance.

The schedule will depend in part on the number of TBMs and other smaller tunneling machines the state uses, with each machine and its crews adding to costs. The 36 miles of tunnels include a mix of short and long segments, dug by different methods.

The longest possible tunnel, described as one alternative in state documents, would stretch 13.8 miles under the Angeles National Forest. Assuming TBMs started at both ends and advanced at 20 feet a day for 261 days a year, the tunnel would take seven years to complete — finishing in 2026. At an advance rate of 10 feet a day, the time would double to 14 years.

The state is considering a different route under the national forest that would instead require a tunnel of just 7 miles. It would take 31/2 to seven years to dig, based on the same advance rates. But that route faces significant political opposition.

Only after the tunnels are dug can the next phase begin: installing track and other equipment in the 36 underground miles. By way of comparison, the Swiss are taking more than four years after tunneling to install track and equipment in the 35.4-mile-long Gotthard Base Tunnel through the Alps, a project spokesman said. Contractors will take an additional nine months to test the systems.

The route through the Tehachapi Mountains from Palmdale to Bakersfield, crossing several major faults, is at an even earlier level of planning.

The last formal analysis was issued more than three years ago. It said that as many as 16 miles of tunnels and as many as a dozen viaducts would be required. The possible routes were later found to be problematic because they are steep and would conflict with a massive wind farm. The agency is working on a new analysis.

So far, land acquisition has been the biggest cause of delays. The authority owns only a small fraction of the parcels it needs for the 300-mile segment from Burbank to Merced.

Available financing also has slowed progress. In 2012, the project was running short of cash until federal officials modified a grant agreement and the California Legislature provided additional funding from carbon emission fees.

The initial operating segment from Burbank to Merced would cost $31 billion, according to the rail agency’s business plan. Officials have secured $14.7 billion, which leaves the state short by $16.3 billion to build the initial operating segment — not including the 31% cost increases forecast by Parsons Brinckerhoff.

The rail authority still has not identified sources for about $53 billion to complete the entire Los Angeles-to-San Francisco line.

State officials are moving ahead without firm financial commitments, contending that private investors will eventually help finance the system. This month, three dozen companies solicited by the state said they are not ready to invest.

As costs rise, the amount of money the state needs will grow.

The 2013 Parsons Brinckerhoff cost estimate showed increases in almost every phase of the project. The company reported higher costs for land acquisition, viaducts, tunnels, electrical systems and professional services, largely driven by difficult segments of track that would run through mountains from Palmdale to Bakersfield.

The document was never made public, and the state rail agency declined a Times request to provide it under the state’s public records act. The Times later obtained it from an engineer close to the project.

Lisa Marie Alley, a spokeswoman for the rail authority, declined to discuss details of the Parsons Brinckerhoff cost estimate, but she said it was “superseded” by the 2014 business plan several months later, which cited the $68-billion estimate.

The cost estimate was one of two times a key contractor has reported bad budget news that the state rejected.

Last year, San Francisco engineering firm URS prepared a planning document that projected an increase of 15%, or nearly $1 billion, in the cost of building the line from Bakersfield to Fresno. URS said that it had been “instructed” by the state to hold costs to the same level as 2012 but that the company was refusing to do so.

The rail authority said later in a rebuttal letter to URS that its statements were misleading and inaccurate. The agency told The Times that the matter was part of a legal dispute that it did not want to publicly discuss. The company no longer has the contract.

Morales, the authority’s chief executive, said he is confident that he can reduce the cost of the project, but he acknowledged that there are no guarantees.

“Nobody can sit here and tell you what something like this is going to cost over a 20-year period,” Morales said. “Any big program like this is loaded with challenges. The day you hear me say I am comfortable is the day I am not telling you the truth or the day I have deluded myself.”

After cost projections for the train rose to $98 billion in 2011, vociferous public and political outcry forced rail officials to reassess. They cut the budget to $68 billion by eliminating high-speed service between Los Angeles and Anaheim and between San Jose and San Francisco.

Morales said that those changes were a normal part of such a big project and that he could not rule out additional changes.

Comment (0)